From the moment Poland became a member of the European Union, the markets of the European Union have become open to Poles. More and more retailers began to offer the sale of their goods on foreign markets. One of the most popular markets for this expansion is the Amazon platform through which we are able to sell our goods. However, it is related to certain obligations in the field of VAT accounting. So what should we remember to be able to sell via the Amazon platform?

According to the EU rules of VAT settlement in mail order sales, if you store goods in a country other than Poland, you are then obliged to register VAT in the given country where the products are stored. Many people choose to sell through the Amazon platform.

Different conditions apply depending on the site, e.g. who will store your goods, who will deliver them and who will handle the VAT?

Amazon reigns supreme in this area, so we need to find out more about how it works. Amazon offers many services for order fulfillment and distance selling. One such package is known as Fulfilled By Amazon (FBA). If your goods are stored in a country other than the one in which you are located, selling in that country is not considered a distance sale. Option FBA for the entire EU, allows Amazon to store goods in any of 7 European warehouses. As a result, choosing a pan-European system can have many tax consequences for your business.

Therefore, it should be noted that selling on foreign markets is obligatory to register for VAT in a territory other than Poland. This can happen not only when we exceed the sales threshold, but registration for VAT may apply to companies that:

they intend to open and maintain warehouses in other countries,

hey sell goods over the Internet to individuals and other entities,

they sell entry tickets to events: conferences, congresses, events, fairs,

they ship goods directly to private persons,

they ship machines and equipment to other countries for installation,

provide real estate services.

However, the most important thing for an Amazon seller is to monitor the sales thresholds of each EU country. You can check what they are in the table below:

Member country | Mail order limit in 2020 |

Austria | 35 000 € |

Belgium | 35 000 € |

Bulgaria | 70 000 BGN (35 791 €) |

Cyprus | 35 000 € |

Croatia | 270 000 HRK (36 291 €) |

Czechia | 1 140 000 CZK (44 873 €) |

Denmark | 280 000 DKK (37 595 €) |

Estonia | 35 000 € |

Finland | 35 000 € |

France | 35 000 € |

Greece | 35 000 € |

Spain | 35 000 € |

The Netherlands | 100 000 € |

Ireland | 35 000 € |

Lithuania | 35 000 € |

Luxemburg | 100 000 € |

Latvia | 35 000 € |

Malta | 35 000 € |

Germany | 100 000 € |

Poland | 160 000 PLN (37 859 €) |

Portugal | 35 000 € |

Romania | 118 000 RON (25 305 €) |

Slovakia | 35 000 € |

Slovenia | 35 000 € |

Sweden | 320 000 SEK (31 390 €) |

Hungary | 35 000 € |

Great Britain | 70 000 GBP (80 197 €) |

Italy | 35 000 € |

If your sales this year are below the tax threshold, then you pay VAT in your own country. If your annual sales exceed the threshold, you pay VAT in the other country. Distance selling thresholds in the EU for physical products vary. Most of them are € 35,000, some are € 100,000 – and of course some countries use their own currency. When your total sales in a country reaches the distance selling threshold, your VAT liability will be transferred to that country and you must register for VAT in that country.

The Distance Selling Thresholds do NOT apply to:

B2B sales. Any goods sold to buyers who have a valid VAT number!

Taxable goods (tobacco, alcohol, gasoline). These goods are always subject to VAT in the destination country. No threshold.

Digital products!

If you want to sell safely and without complications on Amazon or another foreign sales platform and not worry about your taxes in other EU countries, about submitting declarations in these countries, do not hesitate and contact us. We will make the taxes not look so terrible, and you will be able to safely sell through Amazon.

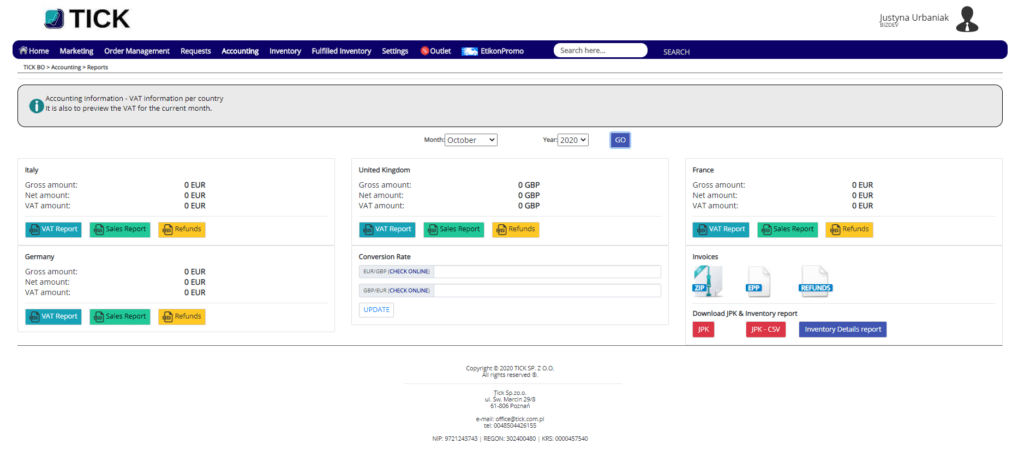

We also have also our specialized system which makes it extremely easy to integrate and automate sales, and thus collects all the necessary information to issue invoices in a given currency, with the appropriate VAT tax of a given country through which we sell. Our system is an intelligent tool that collects information about sales in a given country and you can easily generate the necessary information to submit an appropriate VAT declaration: