INTRASTAT in Germany

Intrastat declaration – in Germany

Intrastat declaration – in Germany

Intrastat in Germany

Information:

INTRASTAT is a data collection system used to provide statistical information on exports and imports of goods within the European Union that are not subject to a customs declaration.

If you trade goods with EU Member States, you are required to submit declarations.

INTRASTAT. Intrastat declarations statistically reflect the actual flow of goods between the 27 Member States of the European Union. Intra-Community trade statistics are compiled on the basis of individual Intrastat declarations, which provide up-to-date data on trade in goods in Germany.

Guide to Intra-EU Trade Statistics

This Intrastat guide contains all the necessary information and codes required for the correct reporting of intra-Community trade statistics. It also provides numerous examples and practical scenarios. Answers to frequently asked questions can be found in Annex 5.

The guide is updated annually.

Increase in annual reporting thresholds (with retroactive effect from 1 January 2025):

Imports: threshold increases from EUR 800,000 to EUR 3 million.

Export: the threshold increases from EUR 500,000 to EUR 1 million.

Companies that do not reach the new thresholds in a given direction of goods flow in 2024 and foreseeably in 2025 will not be obliged to submit reports. However, voluntary registration is possible.

Changes to corrections of reports:

The correction thresholds remain unchanged.

There is no obligation to correct subsequent changes, unless at the time of notification it was already known that the data could change.

Simplifications in the use of collective commodity codes (9990) and higher limits for grouping different goods under one number in accordance with § 30 and 31 AHStatDV.

Detailed information is available in point 6 of the guide.

These changes will make Intrastat reporting more transparent and less burdensome for companies.

Kto ma obowiązek składania informacji?

In a simplified form, Intrastat declarations must be submitted by entities carrying out intra-Community transactions.

Obligation to report shipment and receipt of goods:

Shipping: Information is provided by the entity making the delivery within the EU in accordance with the Value Added Tax Act (UStG).

Acceptance: The obligation lies with the company that acquires the goods within the framework of intra-Community trade.

Private individuals are not required to register, however in some cases the supplier may be required to report both the dispatch and receipt of goods in another EU country.

Special cases of submissions:

Chain Transactions: The report must be submitted by the sender and the ultimate recipient, but not by the intermediary.

Import from outside the EU: If customs clearance does not take place in Germany, but e.g. in the Netherlands (procedure 42), an additional import declaration may be required.

Consignment warehouse: If the supplier is not registered for tax purposes in the country where the warehouse is located, the obligation to file a declaration falls on the buyer.

VAT number and substitute declarations:

From 2022, it is mandatory to provide the recipient’s VAT number in declarations.

In chain and triangular transactions, there may be difficulties in determining the correct VAT number.

If the recipient’s VAT number is not available, a so-called fictitious invoice recipient number is used.

Fictitious numbers for recipients without VAT EU:

Private persons: QN999999999999

Small companies, offices, institutions: QV999999999999

Terms and representation:

Intrastat reports must be submitted monthly, separately for shipments and receipts.

It is possible to appoint a proxy to submit declarations, but he must have a registered office in the EU.

INTRASTAT registration in Germany

INTRASTAT registration in germany

Why You Should Choose Us?

We have many years of experience with the company, we have been operating on the market for 12 years. We approach each client with extraordinary care.

We try to solve each client’s case individually.

What do we offer?

We offer you a range of solutions related to online sales.

Thanks to our experience and conducting foreign sales, we were able to develop the services we offer.

Our Services include:

– sale of the system for e-commerce activities;

– VAT registration on European markets;

– Registration for INTRASTAT in France, Germany, Spain, Italy, the Czech Republic, Poland and Slovakia

Is there a de minimis limit for submissions?

In Germany, companies subject to VAT are exempt from the obligation to file Intrastat declarations if their shipments to other EU countries or receipts from these countries did not exceed certain value thresholds in the previous year. These are currently €500,000 for shipments and €800,000 for receipts, and from 2025 they will be raised to €1 million and €3 million respectively.

The reporting obligation only applies to the direction of goods flow (dispatch or receipt) for which the threshold was exceeded. If the threshold is exceeded during the current calendar year, the company must start reporting from the month in which it occurred.

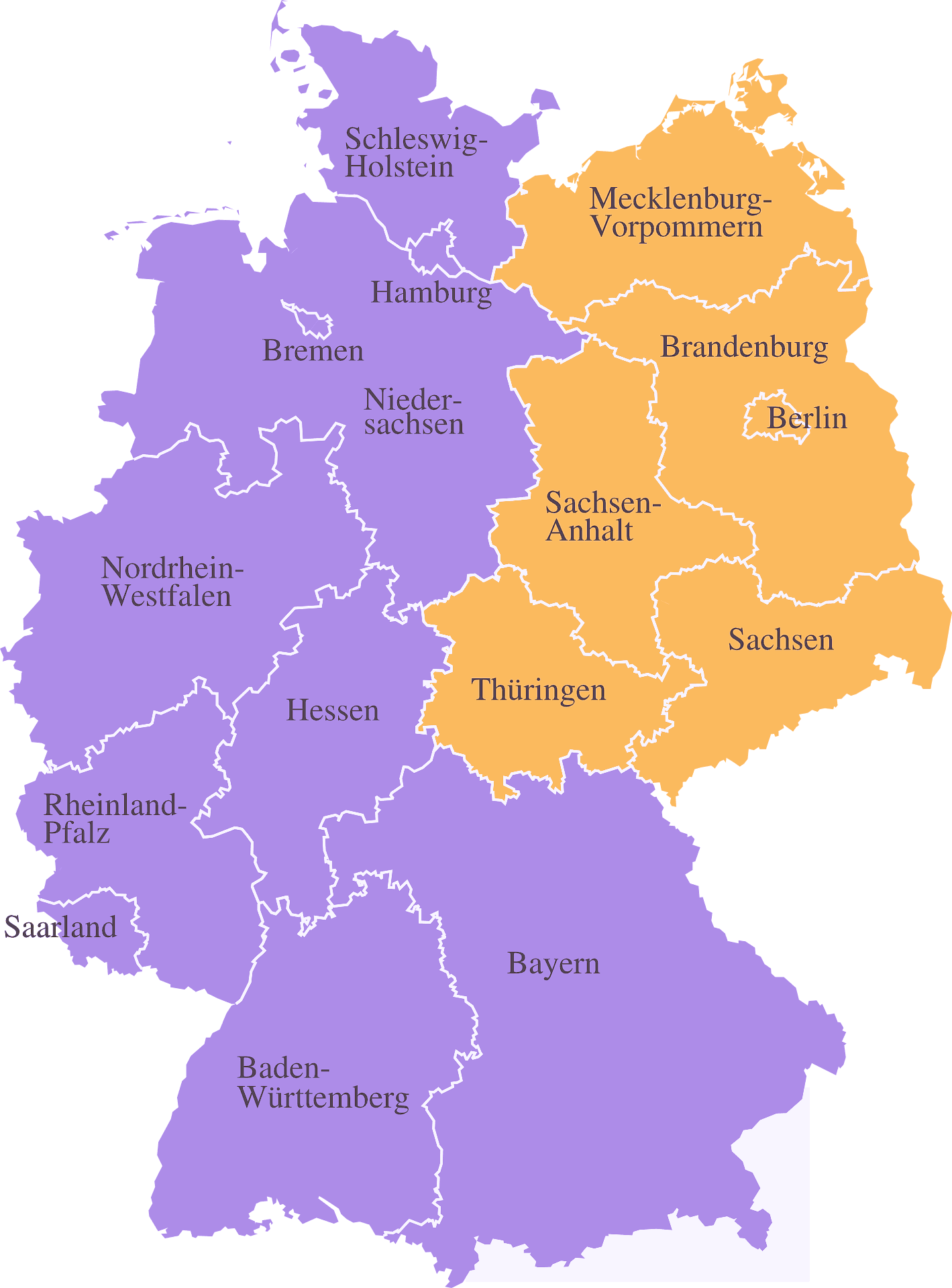

Each EU country sets its own reporting thresholds, which differ from each other. This is due to the need to record a certain proportion of the goods flow in a given country.

In the German Intrastat system, there is no de minimis limit for low-value products, which means that all goods subject to reporting must be reported, regardless of their value.

Contact Us with Us

Would you like to know our offer?

Don't hesitate, contact us by phone or via the contact form.

Annex 3 to Guide to Intra-EU Trade Statistics contains a list of exclusions. The reporting obligation does not apply to, among others, certain temporary movements of goods for a period of up to 24 months (e.g. rental, operational leasing), as well as transport related to repairs and professional equipment. However, transactions related to contract processing must be reported.

Additional simplifications, such as the use of summary numbers and the summary of commodity codes, can be found in Chapter 6 of the Guide to Intra-EU Trade Statistics.

If you need help with INTRASTAT registration in Germany

The reports are prepared monthly and can only be submitted electronically – using the IDEV ID or, in the case of large data sets, via eStatistics.core, which is highly recommended.

In response to numerous questions about how to fill out the reports correctly, the Federal Statistical Office has developed the Guide to Intra-EU Trade Statistics, which contains detailed instructions and numerous examples.

If so, please contact us via the contact form.

Country

Germany

Country Code

DE

delivery

3 million euros

shipping

1 million euros

Filing VAT returns

monthly

TICK EU

Where do we register INTRASTAT in the EU?

Develop your business in accordance with VAT regulations

Sign up for our free newsletter to receive valuable information, news and professional advice from our VAT experts. Stay up to date and develop your business in compliance with the regulations.